Global Risks Weekly Roundup #17/2025: India-Pakistan standoff, Iran and Ukraine talks, AI time horizons

Executive summary

After a terrorist attack in Kashmir left 26 dead, relations between India and Pakistan sharply deteriorated, culminating in the exchange of fire across the border between the two countries. Forecasters examined the possibility of escalation.

The third round of nuclear talks between the US and Iran concluded. On the same day, a blast at Iran’s Bandar Abbas port left hundreds injured, while Trump had a positive face-to-face meeting with President Zelensky in the Vatican City following another rocky week for US-Ukraine relations.

OpenAI’s new models suggest that the length of tasks that AIs can do is now doubling roughly every four months.

Audio narrations of this blog are available on our podcast. Search “Sentinel Minutes” or subscribe via Apple Podcasts, Spotify, RSS, or other platforms.

Geopolitics

Asia

An attack by militants in Indian-administered Kashmir killed 26 people, the worst terrorist atrocity in the region since 2019. A group called the Kashmir Resistance Front claimed responsibility.

Following this, India expelled Pakistani diplomats and suspended the Indus Waters Treaty (with Pakistan saying that any disruption to water supply would be an act of war). Pakistan in turn suspended a 1972 peace treaty with India and closed its airspace to Indian planes (which will mean that flights from India to Europe and North America could take around two hours longer). Indian and Pakistani ground troops also exchanged fire across the Line of Control on consecutive days.

The implications of India’s suspension of the Indus Waters Treaty are nuanced. India is very unlikely to be able to halt the flow of much water to Pakistan during high-flow periods, because it lacks the storage infrastructure and canals necessary to do so. But during the dry season (December to May), when water flows are lower, India’s existing infrastructure might be able to store enough water to have a material impact on Pakistan’s supply. India could also stop sharing data with Pakistan, which could hinder irrigation, flood forecasting and hydropower efficiency in Pakistan and affect the drinking water there. An even more aggressive action would be to release silt from its reservoirs without warning Pakistan. However, because the Indus River originates in Tibet, Pakistan’s ally China could retaliate against India.

On the question of whether and how this will escalate further, The Economist's Shashank Joshi assigns a 60% probability to India conducting an airstrike on Pakistani soil by the end of May, with some former Indian officials pointing the finger at Pakistan's security establishment for allegedly aiding and abetting Kashmiri militants. If airstrikes were to be carried out, they would be the first since that larger attack in 2019.

Our forecasters looked at the broader question of whether there will be a conflict between India and Pakistan that results in the death of more than 1,000 military personnel (combined) within the next six months, with an aggregate of around 9% (range: 7%-12%). On the one hand, the BJP government will want to look strong on defence and Pakistan’s government might find it difficult to control all of its factions. The suspension of water and peace treaties also seems fairly unprecedented. On the other, the base rate for an India-Pakistan war on this scale is low, with only a 4-5% chance per year since 1947.

Conditional on this happening, they also forecast whether a nuclear weapon would be used within six months, with an aggregate of around 1.5% (range: 0.3%-10%). On the one hand, a war was fought in 1999, when both powers possessed nuclear weapons, and the conflict did not escalate this far. On the other hand, if 1,000 troops are killed, emotions will be running higher than they already are, with Pakistan’s railway minister warning that the country’s nuclear weapons are “not kept as models” but are there “only for India”.

Elsewhere, China claimed sovereignty over a disputed reef close to an important Philippine military base in the South China Sea.

The UK's Royal Navy is prepared to sail through the Taiwan Strait, despite China claiming it as its own internal waters (contrary to international agreements). In 2021, the Carrier Strike Group did not sail through the Strait to avoid provoking China.

Europe

Russian President Vladimir Putin reportedly offered to freeze the conflict along the current frontline as part of a Ukraine-Russia peace deal. This would represent a concession in that Russia previously stated that it wanted control of some Ukrainian territory that it doesn't currently occupy. In exchange, the US may be preparing to recognize Crimea as Russian.

However, Russia continues to reject the presence of NATO/European countries in Ukraine as part of a peace settlement, while Ukraine says it will never recognize Crimea as Russian. The US has proposed a non-NATO peace force to patrol any ceasefire line in addition to the European contingent proposed by the UK and France.

Relatedly, the United Kingdom is reportedly reconsidering its plan to send a significant number of troops to Ukraine to protect cities, ports and energy infrastructure, although British PM Keir Starmer insists that all options are on the table. The US has been unwilling to provide a ‘backstop’ for any Franco-British force.

US envoy Steve Witkoff met with Putin in the Kremlin, hours after a car bomb killed a top Russian general in Moscow. Russia said that the meeting had narrowed the differences between the Russian and American positions, while Trump said that Crimea will “stay with Russia”.

Kyiv’s Mayor, former boxer Vitali Klitschko, became one of the most high-profile Ukrainian politicians to suggest that Ukraine will have to give up land for peace. He is a political opponent of Ukraine’s President Zelensky.

Meanwhile, Zelensky said that Ukraine would never accept Russian sovereignty over Crimea. Trump berated him on social media, saying that Ukraine doesn’t need to accept it but that such statements make peace more difficult to achieve. Trump also told Russian President Putin to “STOP!” after Ukrainian cities were attacked by Russia.

Trump and Zelensky later had a constructive face-to-face meeting in the Vatican City, after which Trump publicly questioned whether Putin is just stringing him along.

Putin has proposed a unilateral ceasefire for May 8-11 “tying it to the celebrations of the 80th anniversary of Victory Day over Nazi Germany.” Zelensky has responded skeptically.

As we publish this brief, Spain and Portugal are under a power outage.

Middle East

The third round of nuclear talks between the US and Iran concluded in Oman. So far, Iran has rejected a demand from the US to rely on imported uranium and is fortifying its buried nuclear sites.

With two carrier battle groups, six B2 bombers stationed at Diego Garcia, three E-3 Sentry AWACS planes in the region, as well as multiple batteries of Patriot and THAAD anti-missile systems in place, the US is in a strong position to act immediately against Iran if a decision is made that the talks are not progressing. Iran, in turn, is negotiating under pressure.

Meanwhile, Moscow might have a role to play in Iran's nuclear talks due to its closer relationship with the country, and Putin discussed the talks with the leader of Oman—who hosted the last round—in Moscow.

On the same day as the talks, there was an explosion at a port in Bandar Abbas in the south of Iran, killing dozens and injuring more than 1,000 people. The port was recently reported to have received sanctioned ships carrying sodium perchlorate (which is ultimately used in Iran’s medium-range missiles) from China. Countries that oppose a US-Iran nuclear deal might also have had an incentive to try to torpedo the talks.

However, Israel denied responsibility for the explosion, and some speculate that it was caused by inadequate handling of chemicals (perhaps the very fuel that was destined for Iranian ballistic missiles), similar to the 2020 explosion in Beirut. Video footage suggests that the explosion was not immediate but followed a fire in a container.

In other news, China and Egypt launched joint military drills close to Israel’s border.

The US continued its strikes against the Houthis in Yemen.

The UN World Food Programme says it no longer has any food in Gaza, following seven weeks of humanitarian aid into the territory being blocked by Israel. Britain, France and Germany called for the blockade to end, while a hospital chief said that Gaza has entered the most severe stage of malnutrition. Polio vaccinations were also halted in Gaza.

United States

Trump claimed that the US should be able to deport immigrants without due process. In the Oval Office, he said, “We’re getting them out, and a judge can’t say, ‘No, you have to have a trial.’ … We’re going to have a very dangerous country if we’re not allowed to do what we’re entitled to do.” On social media, he posted that, “We cannot give everyone a trial, because to do so would take, without exaggeration, 200 years.”

A federal judge ordered the Trump administration to facilitate the return of a second immigrant who was deported to Venezuela.

The FBI arrested a county judge in Wisconsin for allegedly obstructing federal authorities who sought to detain an undocumented immigrant, by escorting the man and his defense attorney through a nonpublic door.

The Trump administration deported a 2-year-old US citizen “with no meaningful process,” along with his undocumented mother and sibling.

Africa

The UN is to reduce food support to millions in Sudan due to a shortfall of hundreds of millions of dollars.

Technology

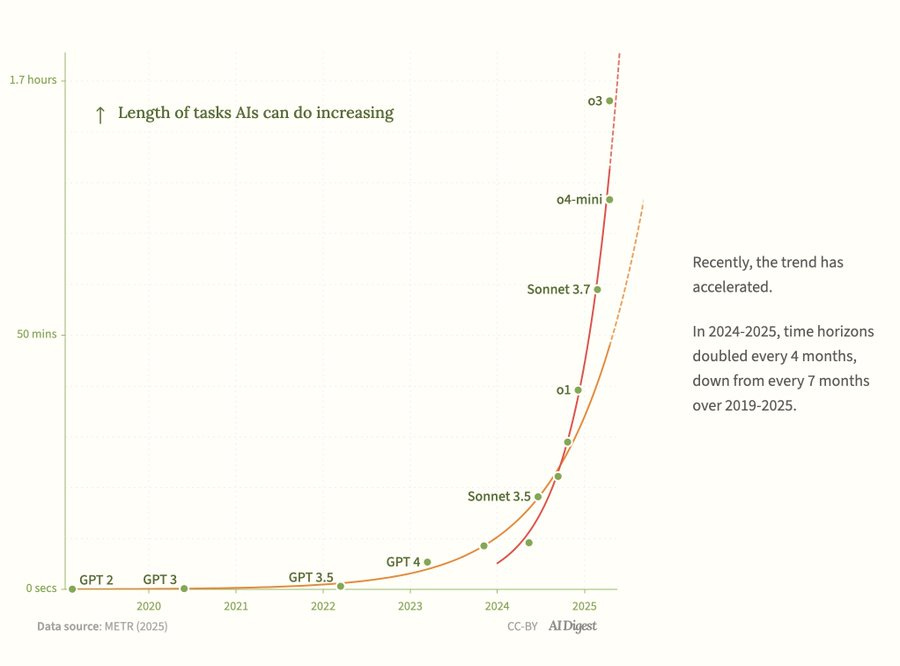

Last month, we reported on the result obtained by METR that AI time horizons have been growing exponentially for the last 6 years, with a doubling time of 7 months.

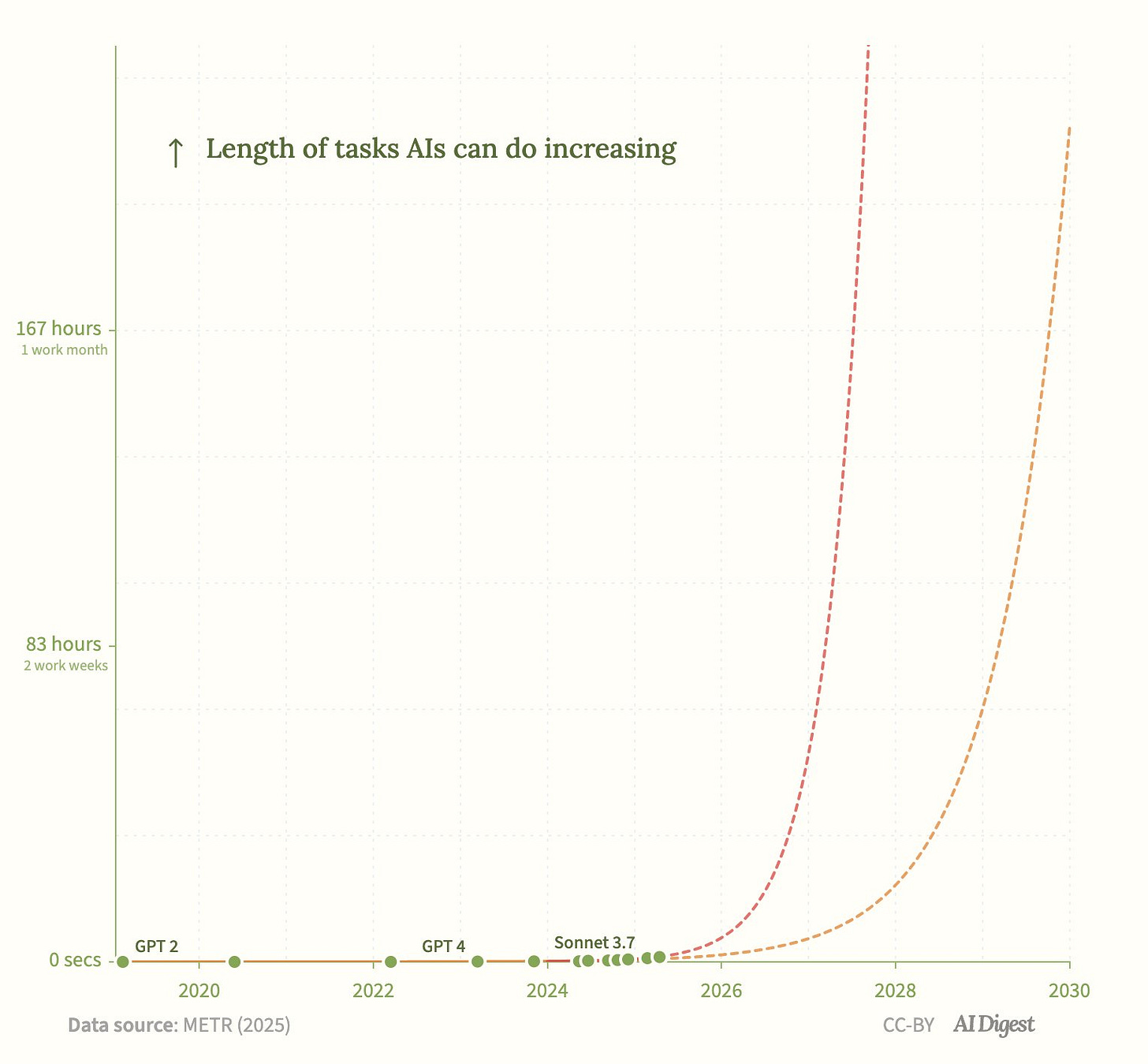

METR claims to have found a "Moore's Law for AI Agents", with the length of tasks that AIs can do reportedly doubling every 7 months or so. The tasks that METR tested the systems on were particularly relevant to AI research and engineering, so this trend seems important for anticipating the point at which a fast takeoff may become possible. The authors of the paper write: “Naively extrapolating the trend in horizon length implies that AI will reach a time horizon of >1 month (167 work hours) between late 2028 and early 2031.” Some have posited that the trend may even be superexponential. However, others have argued that these findings are somewhat contingent on task selection.

OpenAI’s new models, o3 and o4-mini, have since been tested and it appears that this doubling time has shortened to 4 months:

This may have significant implications for AI timelines, pushing forward the straightforwardly extrapolated trend of when AI systems would be able to do 1 month tasks by about 2 years:

For some forecasters, this is a deeply concerning possibility, as they believe we have neither the technical assurances that superhuman AI would be safe, nor the institutional preparedness for a change of such magnitude (exponential growth being particularly difficult for policymakers to grapple with).

Other forecasters bring up the possibility that previously AI companies were releasing models more slowly than they created them, in part for safety testing, but that they have recently accelerated and released their backlog—particularly OpenAI, which might make the super-exponential trend a temporary catchup phenomenon. Additionally, the underlying benchmarks might not be capturing software-engineering tasks properly.

In other news, an open letter by legal, governance, and AI experts, along with a group of former OpenAI employees was published, addressed to the Attorneys General of California and Delaware, arguing that OpenAI should not be allowed to convert to a for-profit company.

A paper investigating the biorisk potential of AI found that OpenAI’s o3 model outperforms 94% of virologists on their Virology Capabilities Test benchmark.

China’s President Xi called for China to become self-sufficient in AI.

Speaking at a Politburo meeting study session on Friday, Xi said China should leverage its "new whole national system" to push forward with the development of AI.

…

He added that AI regulations and laws should be speeded up to build a "risk warning and emergency response system, to ensure that artificial intelligence is safe, reliable, and controllable."

OpenAI struck another media deal, this time with the Washington Post.

South Korea’s data protection authority says DeepSeek transferred user data and prompts to China without user consent.

An OpenAI executive, testifying at Google’s antitrust trial, said OpenAI would be interested in buying Google Chrome if Google is forced to sell it.

Google says workers could save 122 hours a year by adopting AI for admin tasks.

TSMC announced new manufacturing technology that will “be able to produce processors that are 15% faster at the same power consumption as its N2 chips”. They say the technology will arrive in 2028.

Amazon has halted some data center leasing talks.

Chinese researchers reportedly built a microchip that doesn’t use silicon or require extreme ultraviolet (EUV) lithography, which only one company in the world (ASML, a Dutch company) can do. Instead, the new Chinese technology employs the semiconductor molybdenum disulfide sandwiched between two layers of sulfur atoms. If this technology could become commercially viable, it would circumvent Western export controls on advanced chips and herald Chinese independence from Western chip technologies.

Global Economy

As uncertainty about tariffs continued to grip markets, the IMF revised its global GDP growth forecasts for the year downward since its January forecasts. The IMF estimates that world GDP will grow by 2.8% in 2025, down from 3.3%. The US economy is expected to be hit hardest by its tariff policy. These figures are still well above the threshold for a global recession. However, our forecasters think that world economic growth in 2025 will likely (66%; range 60%-70%) end up lower than the current IMF estimate, especially if the US continues to impose substantial tariffs on imported goods, though a global recession is considered unlikely.

The US stock market improved somewhat this past week on the news that Trump might lower tariffs on Chinese goods and that he wouldn’t try to fire the Fed chair. Still, investors continued to shift away from US assets; the 10-year Treasury yield remains high, at over 4.2%, and foreign investors sold US corporate bonds at the highest rate in 5 years.

The CEOs of Walmart, Target and Home Depot met privately with Trump and told him that his tariff policies would cause stores’ shelves to start to go empty within the coming weeks. Craig Fuller of Freightwaves reports that trucking volumes out of the Port of Los Angeles are near annual lows. On top of that, ocean container bookings have fallen more than 60% over the past three weeks. Ryan Petersen of Flexport tweeted, “We will also have mass shortages this summer as the goods don’t show up. The first ships carrying goods paying the duties arrived on Monday. And the decline in freight arrivals will hit in the coming weeks.” Fuller also said, “August is the period when we'd expect there to be the first major product shortages.” Moreover, if imports do not rebound over the next few months, US business will lose out on Black Friday and subsequent holiday sales. Some shortages might be overcome by consumers buying directly from Chinese companies—cutting out US companies as middlemen.

In addition to shortages, if substantial tariffs continue to be imposed, falling imports will also likely cause devastation in the industries that move imported goods. Fuller writes, “Import volumes will start drying up the first week of May. Companies tied to imports: port operators, truckers, warehouses, forwarders, and railroads will all struggle. Layoffs the following week. POTUS needs to declare victory by mid-next week, or we will be looking at a doomsday scenario for West Coast supply chain workers. The logistics industry employs 8 million people in the US.”

US tariffs are not currently helping manufacturing in the US. The new orders index, which tracks new orders of goods manufactured in the US, is at its lowest point since Covid. And some manufacturers are laying off employees.

Chinese factories are slowing production and laying off workers because US customers have canceled or suspended US orders.

Bio

Two companies signed an agreement to jointly develop an H5 mRNA flu vaccine that would offer protection against all major H5 clades. This nearly universal H5 vaccine could potentially be delivered mucosally. One of the companies uses AI to aid antigen design for the vaccine.

Largely eradicated diseases in Africa are at risk of returning due to budget cuts.

Due to low vaccination rates in the US, researchers warned measles could become endemic again within two decades.

The WHO finalized a draft agreement for pandemic prevention, to be voted on in May.

The CDC shut down key labs for hepatitis and STI testing after layoffs.